At a glance:

- Having multiple income protection policies can offer enhanced coverage amounts and protection against various risks.

- However, this approach may lead to higher premium payments and coordination challenges during the claiming process.

- Assessing individual circumstances and understanding policy interactions is crucial in determining the worth of having multiple policies.

Income protection policies act as a crucial safety net, providing financial support during challenging times when disability from illness or injury hinders your ability to work. But can you have multiple income protection policies to bolster your coverage? In this comprehensive blog, we will explore the concept of having multiple income protection policies, delve into the legal and policy guidelines surrounding them, and examine the potential pros and cons for individuals seeking to fortify their financial safety nets.

Understanding Income Protection Policy

Before delving into the intricacies of having multiple income protection policies, it’s vital to grasp the fundamental principles of an income protection policy. An income protection policy acts as a financial buffer, offering a regular income stream to policyholders during periods when they cannot work due to injury or illness. This form of insurance ensures that critical financial commitments can still be met, providing peace of mind during uncertain times. It is imperative to understand how income protection insurance is calculated.

Be Aware of the Zombie Protection Policy Scandal in Australia

Recent times have witnessed the notorious “Zombie Protection Policy” scandal in Australia. This scandal unveiled unethical practices by certain insurers, where inactive policies continued charging premiums without adequate coverage.

In a report published earlier this year, the Productivity Commission found widespread issues with Australia’s superannuation fund management systems, resulting in multiple income protection policies.

Over 17 percent of workers in the country hold multiple super accounts, mainly due to changing jobs during their careers. Duplicate accounts make up one-third of all super accounts nationwide.

Consequently, many Australians pay fees for ‘zombie’ insurance protection policies that provide no coverage. Many people pay multiple premiums but cannot claim on multiple policies at once.

In addition, members cannot claim income protection while unemployed, but Super Funds will still charge fees and premiums to them. Zombie income protection policies can erode a worker’s retirement pot by as much as $60,000 throughout their career.

To safeguard against such issues, choosing reputable insurers like Aspect UW and staying informed about your insurance arrangements is imperative.

Multiple Income Protection Policies: Can You Have Them?

Legal and Policy Guidelines:

When it comes to having multiple income protection policies, the answer is generally yes. However, income protection insurance typically includes offset clauses to prevent policyholders from being overcompensated while disabled. This means the combined maximum benefit you can receive from all your policies is usually limited to around 75% – 85% of your income.

Scenario Analysis: When Multiple Policies Make Sense

While not necessary for everyone, there are scenarios where having multiple income protection policies may be advantageous.

Freelancers with Fluctuating Income Streams:

Freelancers often experience variable income streams due to the nature of their work. In this scenario, having multiple income protection policies can be beneficial. For example, a freelancer may have a primary income protection policy covering their regular income and another specifically addressing their highest-earning months. This way, they can ensure adequate coverage during low and high-income periods.

Professionals with Unique Risks:

Certain professions expose individuals to specific risks that may not be fully covered by a standard income protection policy. For instance, a surgeon or medical professional may have a primary policy that covers disability resulting from illness or injury. Simultaneously, they may acquire a specialised policy that provides additional coverage for disability due to needlestick injuries, which is a unique risk associated with their occupation.

How Do Multiple Income Protection Policies Work?

It’s crucial to understand how they function and the implications of such arrangements to make informed decisions about having multiple income protection policies.

Overlapping Coverage and Cost Effectiveness:

Multiple policies can result in overlapping coverage, where some benefits may be duplicated. For instance, if you have two policies covering the same percentage of your gross salary, you may pay higher premiums without receiving additional benefits for the overlapping portion.

Impact on Benefits and Payouts:

Let’s consider an example where an individual has two income protection policies with a maximum benefit amount of $5,000 per month in case of disability. If one policy pays out $3,000 per month, the second policy may provide an additional $2,000 per month. However, it’s essential to understand that the combined payout cannot exceed the maximum benefit amount specified in both policies.

Benefits of Holding Multiple Policies:

Multiple income protection policies aim to help people manage short- and long-term financial losses associated with illness or injury. Common strategies include:

- Coverage is provided for the first two years following a disability but at a reduced benefit (60% of income, for example).

- Then, you can combine that with a policy that pays 75% of the insured’s income up to five years after a two-year waiting.

Get a free online income protection quote from Aspect, and make sure you only take out policies from companies with long-standing histories. Let’s delve into the benefits of holding multiple policies:

Tailored Coverage for Different Phases of Disability:

Individuals can create a tailored coverage plan by combining policies with varying waiting periods and benefit periods. For instance, they can receive cover in the first two years of disability with one policy that pays a reduced benefit (e.g., 60% of income) and then combine it with a policy that has a two-year waiting period and pays a higher benefit (e.g., 75% of income) up to age 65. This approach ensures adequate financial support during different phases of their recovery.

Higher Coverage Amounts:

With multiple policies, individuals have the flexibility to secure higher coverage amounts. While each policy is subject to a maximum benefit amount (usually up to 75% – 85% of gross annual income), having more than one policy allows individuals to aggregate benefits from multiple sources, providing a more substantial financial safety net.

Covering Unique Risks:

Certain occupations or lifestyles may expose individuals to specific risks that a standard income protection policy may not fully cover. By having multiple policies, individuals can address these unique risks by obtaining specialised coverage.

Limitations and Potential Pitfalls:

While having multiple income protection policies can be advantageous, there are limitations and potential pitfalls to consider.

Offset Clauses and Benefit Limitations:

Each income protection policy typically includes offset clauses, ensuring that policyholders cannot be overcompensated while disabled. This means the combined maximum benefit from all policies is generally capped at around 75% – 85% of the insured person’s income. This limitation incentivises policyholders to recover and return to work rather than remain financially secure while disabled.

Coordination Challenges:

Managing multiple policies can be complex, especially during the claiming process. Policyholders must coordinate and navigate each policy’s various procedures and requirements to ensure a smooth and successful claim.

Higher Premiums:

Having multiple policies will generally result in higher overall premium payments. Policyholders should carefully assess whether the additional benefits from holding multiple policies justify the increased cost.

Scenario 1

Consider the case in which you have two income protection policies. The two of them each cover 50% of your income. You’ll only receive a payout from one of these policies as both of the insurers’ maximum payout is 50%. If you aren’t aware of this, you’ll soon discover that your second policy was a waste of money.

This is not always the case, however. Consider a situation where you have two income protection policies, each covering 25% of your earnings. With the maximum limit of 50% set by the insurance companies, you could claim on both policies and receive payouts. As opposed to the number of policies, it’s all about the level of coverage.

Claiming Process:

The claiming process for multiple income protection policies may require extra attention and understanding. Here are key considerations for the claiming process:

Combined Benefit Cap: As mentioned earlier, the combined benefit from all policies is usually limited to around 75% – 85% of the insured person’s income. Policyholders must be aware of this cap to manage their expectations during the claiming process.

Impact of Other Income Sources: Other income sources can affect income protection payments during the claiming process. This includes regular payments from another insurance policy, superannuation/pension, workers’ compensation, motor accident claims, or any other sources of income.

Superannuation Fund Policies: If an individual has income protection coverage through their superannuation fund and holds another policy outside of super, the benefit limitation still applies. Some super funds may offer an extended waiting period feature, allowing policyholders to receive benefit payments from their income protection policy inside super even when they have additional coverage from another insurance provider. However, not all superannuation funds offer this feature, so it’s essential to consult with the respective fund to understand the specifics.

Considerations When Applying for Multiple Income Protection Policies:

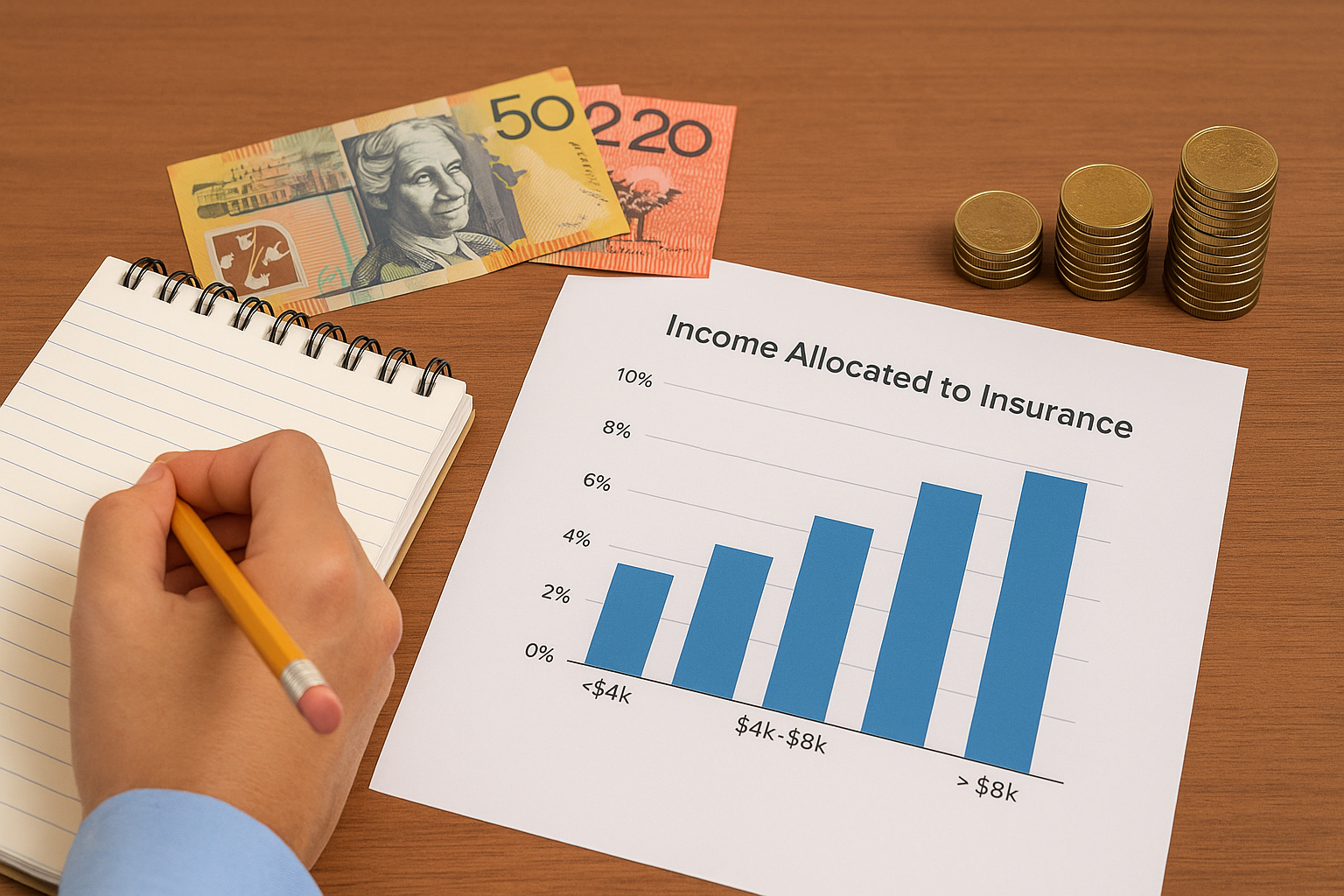

To make the most of multiple income protection policies, several key considerations should be taken into account, such as income protection insurance prices in Australia.

The Importance of Full Disclosure:

When applying for multiple income protection policies, full disclosure is paramount. Providing accurate and complete information about your health, occupation, and other relevant details is essential to avoid potential claim denials due to non-disclosure.

Understanding the Implications of ‘Other Income’ Clauses:

Many income protection policies contain ‘Other Income’ clauses, which may affect your benefits if you have multiple policies. Understanding these clauses and their impact is crucial to manage your expectations effectively.

The Role of Superannuation in Income Protection:

Superannuation funds often offer income protection as part of their membership benefits. Understanding how this interacts with standalone policies is vital in making informed choices.

Is Having Multiple Income Protection Policies Worth It?

To make the most of having multiple policies, you can consider having two income protection policies with complementary waiting and benefit periods. For instance, suppose you already have an income protection policy through your superannuation fund with a 30-day waiting period and a 2-year benefit period. In that case, you can opt for additional income protection coverage with a 1-year waiting period and a benefit period that continues until the age of 65. This approach allows you to bridge the gap between the waiting periods, ensuring continuous financial support during various periods of disability.

Having multiple income protection policies can provide an additional layer of financial security for income earners. However, it is essential to weigh the pros and cons, understand policy interactions, and make informed decisions based on your unique circumstances while choosing the right cover. Prioritising full disclosure, seeking professional guidance, and choosing reputable insurers like Aspect UW can ensure a robust and comprehensive financial safety net.

FAQs

Can I have more than 1 income protection policy?

Yes, you can have multiple income protection policies. There are no legal restrictions on having more than one policy.

What is the maximum income protection coverage in Australia?

The maximum income protection cover varies among insurers and policy types. It’s essential to review each policy’s specifics to understand the coverage limits and options available.

Can I claim income protection twice?

If you hold multiple income protection policies and meet the claim requirements for each policy, you may be eligible to claim benefits separately from each policy.

What is the maximum sum insured for income protection?

The maximum sum insured for income protection policies depends on various factors, such as the insurer, policy type, and individual circumstances. It’s best to consult with insurance providers to determine the appropriate coverage amount for your needs.