At a glance:

- Redundancy Cover Basics: Understand what redundancy cover is and how it differs from income protection insurance.

- Key Differences: Learn the primary differences between income protection insurance and redundancy cover.

- Common Concerns Addressed: Find answers to frequently asked questions about unemployment and insurance coverage.

- Informed Decisions: Gain insights to make well-informed choices for your financial security.

Income protection insurance is designed to safeguard your financial stability by providing a portion of your income if you’re unable to work due to illness or injury. However, with the changing dynamics of the job market, many people are increasingly concerned about job security and wonder whether income protection insurance also covers redundancy. Redundancy, an unexpected and often distressing event, can significantly impact your financial well-being.

Understanding whether your income protection insurance extends to redundancy is crucial for making informed decisions about your financial future. In this blog, we’ll explore the nuances of income protection insurance, how it compares to redundancy cover, and address common concerns to help you navigate your options.

Redundancy Cover

Redundancy cover is a specific type of insurance designed to provide financial support if you lose your job due to redundancy. Unlike income protection insurance, which typically covers you if you’re unable to work due to illness or injury, redundancy cover directly addresses the risk of job loss. This type of cover can offer a temporary income replacement for a set period, usually up to 12 months, while you search for new employment.

Redundancy cover can be a standalone policy or an add-on to an existing income protection insurance plan. It’s important to note that redundancy cover often comes with specific conditions and exclusions. For instance, there might be a waiting period before the cover kicks in, and it generally does not cover voluntary redundancy or resignation. Additionally, policies may require proof that the redundancy was involuntary and beyond your control.

When considering redundancy coverage, it’s essential to read the terms and conditions carefully to understand what is and isn’t covered. This understanding will help you avoid any surprises and ensure that you have the right protection in place for your circumstances.

Income Protection VS Redundancy – What’s the Difference?

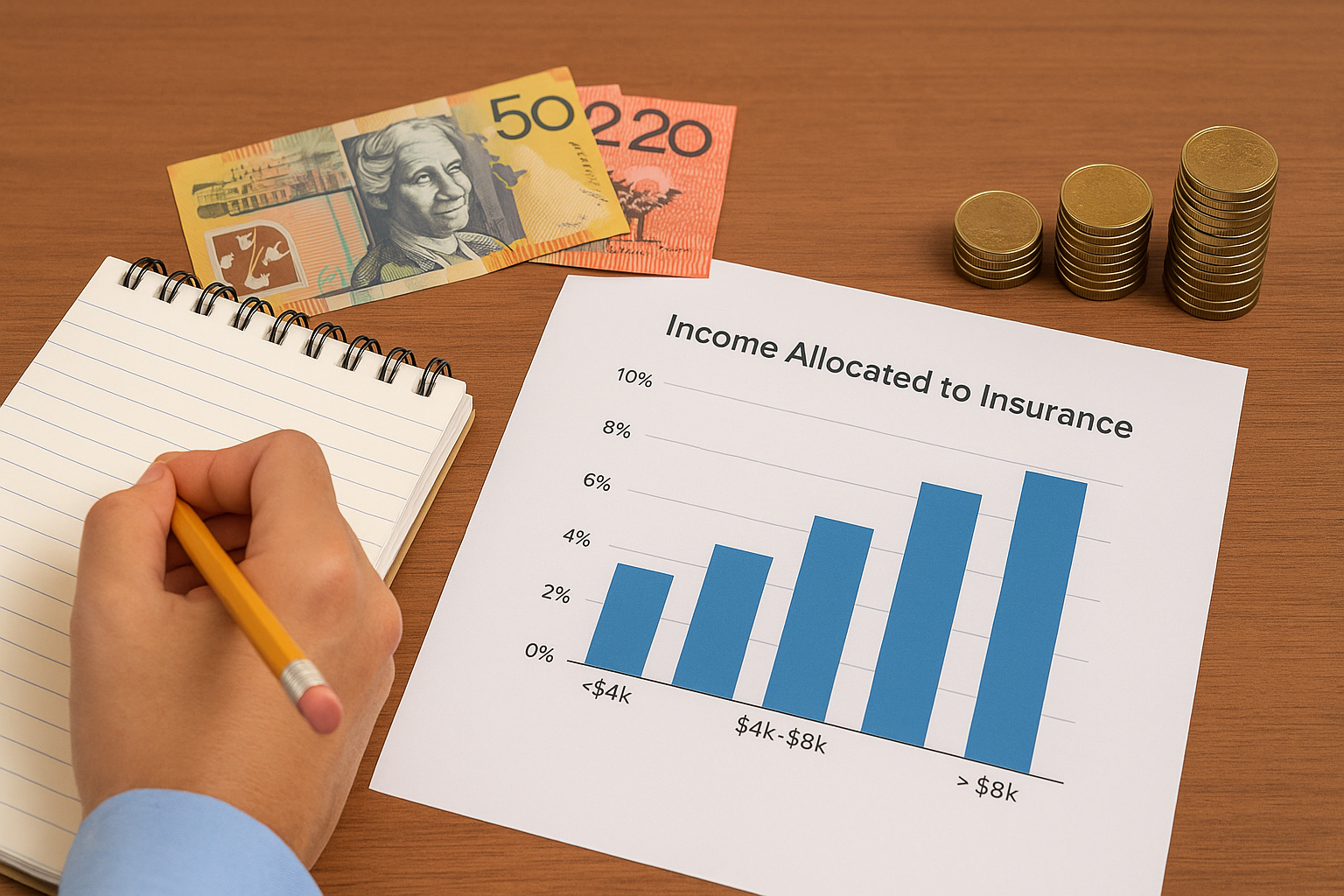

Income protection insurance and redundancy coverage serve different purposes, and it’s crucial to understand their differences to make an informed choice. This insurance is designed to provide a portion of your income if you are unable to work due to illness or injury. This coverage can last until you can return to work or reach a predetermined age, such as retirement. The benefit amount is typically a percentage of your regular income, and the policy can be tailored to meet your specific needs, including waiting periods and benefit periods.

In contrast, redundancy cover specifically addresses job loss due to redundancy. It provides temporary financial support, usually for up to 12 months, while you seek new employment. Redundancy cover is not designed to replace your income in the long term, but to offer a financial buffer during a period of job transition.

To illustrate the difference, consider Jane, a marketing executive who purchased both income protection insurance and redundancy cover. When Jane was diagnosed with a serious illness, her income protection insurance provided her with 75% of her regular income while she was unable to work. Later, when her company underwent restructuring, and she was made redundant, her redundancy cover kicked in, providing her with financial support for six months as she looked for a new job.

Jane’s experience highlights the complementary nature of these two types of coverage. While income protection insurance safeguarded her against loss of income due to illness, redundancy cover provided a financial cushion during her job search.

Some Common Concerns

Will I get paid by my income protection policy if I am unemployed?

If you become unemployed, your income protection policy will not typically pay out benefits. These policies are designed to replace income lost due to illness or injury, not unemployment. Therefore, if you lose your job and do not have redundancy cover, you may need to rely on other financial resources or government support.

How will being unemployed affect my income protection policy?

Being unemployed can impact your income protection policy in several ways. Firstly, if you are not actively employed when you purchase the policy, you may face restrictions or higher premiums. Insurers often require proof of regular income to determine the benefit amount and eligibility. Secondly, if you become unemployed after purchasing the policy, you may still need to pay premiums to keep the coverage active. Failure to do so could result in the policy lapsing, leaving you without protection when you return to work.

Can I claim redundancy cover if I resign?

Typically, redundancy cover does not provide benefits if you voluntarily resign from your job. Redundancy cover is designed to protect against involuntary job loss due to factors such as company downsizing or closure. If you choose to leave your job, this would generally be seen as a voluntary decision, and redundancy cover would not apply.

It’s important to understand the specific terms of your policy, as some policies might have nuances or exceptions, but in general, voluntary resignation is not covered. This means you should consider your job security and potential risks before making any significant career moves without adequate protection in place.

Understanding the distinction between income protection insurance and redundancy coverage is essential for comprehensive financial planning. While income protection insurance provides long-term support in case of illness or injury, redundancy cover offers temporary financial assistance during periods of job loss due to redundancy.

Both types of cover can complement each other, providing a robust safety net in different scenarios. By addressing common concerns and knowing what each policy covers, you can make informed decisions to protect your financial well-being, no matter what life throws your way.

For those seeking specialised advice and tailored insurance solutions in Australia, Aspect Underwriting is a trusted partner. With expertise in crafting policies that meet your unique needs, Aspect Underwriting ensures you have the right coverage to secure your financial future against unforeseen events like redundancy and illness. Reach out to our expert team to explore your options and safeguard your livelihood.