At a glance:

- Offering a thorough comparison, this article delves into Group Income Protection Insurance and Personal Income Protection Insurance.

- Examining their advantages, disparities, and factors for selection provides valuable insights.

- Employers usually furnish Group Income Protection Insurance within employee benefits, safeguarding against disability from accidents or illness, whether at work or elsewhere.

Welcome to our comprehensive comparison of Group Income Protection Insurance and Personal Income Protection Insurance. In this article, we aim to provide a detailed analysis of the benefits, differences, and important considerations when choosing between these two types of insurance.

Whether you are an employer looking to provide policy coverage for your employees or an individual seeking income protection, understanding the distinctions between Group and Personal Income Protection Insurance is essential. We will explore the key features, advantages, and potential tax implications of each option, empowering you to make an informed decision based on your unique needs.

So, let’s dive into this comprehensive comparison and uncover the fine details of Group and Personal Income Protection Insurance.

Group Income Protection vs Individual Income Protection

Group Income Protection

Insurance policies that employers buy on behalf of their employees is called group income protection. This policy protects the income of employees in the event of total or partial disability caused by an accident or illness. It is designed to assist the company’s employees financially if they can’t work due to health reasons that occur outside of the work environment. This can often be very beneficial when it comes to employee satisfaction and, of course, retention.

The employer pays an agreed-upon premium every month, and a claim is filed when a worker is injured, ill, and cannot work. The company usually receives the benefit payout from the insurer; not the employee. They then process the benefit payment through the company payroll system.

You can purchase group income protection for up to 90% of your employees’ gross salaries. A lot of insurers offer different amounts of cover, so speaking with an adviser like Aspect Underwriting is recommended to ensure you get the appropriate amount of coverage.

The employer can choose when to make or defer the payments (waiting period), as well as when to start and end the employee’s payment benefits (benefit period). It comes in handy to have expert assistance for these types of decisions to ensure both the company and employees’ benefits are considered.

Insurance companies are likely to offer additional services other than benefit payments to help the organisation cope with the loss of a valuable employee, as well as to help the employee recover so that they can return to work. This is a win-win since it saves you money from needing to replace the employee, and it also allows the employee to recoup.

Group Income Protection Insurance is an insurance policy provided by employers as part of an employee benefits package. It offers financial protection to employees in the event of a disability caused by accidental injury or sickness. Let’s explore the concept, features, benefits, and limitations of Group Income Protection Insurance.

Concept and Features

Group Income Protection Insurance provides several key features to safeguard employees’ income during periods of disability. These features include:

Total Disability Benefit:

If an insured person is totally disabled and unable to work, this benefit provides financial support.

Partial Disability Benefit:

In case of partial disability, where an insured person can work but with limitations, this benefit provides a partial income replacement.

Death Benefit:

If an insured person passes away while receiving a disability benefit, an additional lump sum benefit is provided to the beneficiary.

Retraining Expense Benefit:

This benefit covers the cost of an approved retraining program for an insured person receiving a disability benefit.

Increasing Benefits (Escalation Benefit):

Disability benefits can be adjusted periodically to keep up with inflation.

Recurrent Disability:

If an insured person experiences a relapse of the same sickness or injury within 6 months of receiving a disability benefit, no waiting period is imposed.

Standard Cover:

Available to eligible individuals who meet the predetermined conditions, this cover ensures protection under the policy.

24-hour Worldwide Cover:

While an insured person is overseas, this cover provides protection around the clock, subject to certain conditions.

Cover While on Leave Without Pay:

The policy continues to provide coverage even when an insured person is on approved leave without pay.

Benefits of Group Income Protection Insurance

Comprehensive Coverage:

Group Income Protection Insurance offers a range of benefits, including total and partial disability coverage, death benefits, and retraining expense coverage.

Employer Provision:

Being part of an employee benefits package, Group Income Protection Insurance is typically provided by employers, relieving individuals of the responsibility to seek individual coverage.

Waiver of Premium:

Premiums are waived while an insured person is receiving a disability benefit, reducing the financial burden during periods of disability.

Limitations of Group Income Protection Insurance

Limited Coverage Customisation:

Group Income Protection Insurance typically provides standard cover, limiting the degree of customisation available to individuals.

Reliance on Employment:

Coverage under Group Income Protection Insurance is tied to employment, which means it may cease when an individual leaves their job.

Potential Tax Implications:

Depending on the specific circumstances, disability benefits received under the policy may have tax implications that need to be considered.

Overview of Personal Income Protection Insurance

Personal Income Protection Insurance is an insurance policy that individuals can purchase directly from insurance providers. It offers financial protection by providing a replacement income if the policyholder is unable to work due to illness or injury. Here’s an overview of the concept, features, benefits, and limitations of Personal Income Protection Insurance:

Concept and Features

Personal Income Protection Insurance is designed to replace a portion of the policyholder’s income if they are unable to work due to a covered illness or injury. The policy typically pays a monthly benefit, which is a percentage of the policyholder’s pre-disability income, helping to cover essential expenses during their recovery period. The policyholder can choose various options, such as the waiting period before benefits start, benefit duration, and level of coverage, to customise the policy according to their needs.

Purchasing Personal Income Protection Insurance

Unlike Group Income Protection Insurance, which is provided by employers, Personal Income Protection Insurance is purchased directly by individuals from insurance providers. This allows individuals to have greater control over the policy terms, coverage options, and premium payments. They can compare different policies, select the one that best suits their requirements, and make direct arrangements with the insurance provider.

Benefits of Personal Income Protection Insurance

Income Continuity:

Personal Income Protection Insurance ensures that individuals can continue to receive a regular income, even if they are unable to work due to illness or injury. This provides financial stability and helps cover living expenses, such as mortgage payments, bills, and daily necessities, during the recovery period.

Customisation and Flexibility:

Personal Income Protection Insurance policies offer customisation options, allowing individuals to tailor the coverage to their specific needs. They can choose the waiting period, benefit duration, and level of coverage that aligns with their financial circumstances and risk tolerance.

Tax Deductibility:

In some cases, the premiums paid for Personal Income Protection Insurance may be tax-deductible. However, the tax implications depend on the specific policy and individual circumstances, so it is advisable to consult with a tax professional for accurate information.

Limitations of Personal Income Protection Insurance

Exclusions and Waiting Periods:

Personal Income Protection Insurance policies often have exclusions for pre-existing conditions and certain high-risk activities. Additionally, there is typically a waiting period before benefits start, during which the policyholder must be unable to work due to the covered illness or injury.

Coverage Limits:

Personal Income Protection Insurance policies may have certain limits on the amount of benefit payable or the duration of benefit payments. It is important to review the policy terms and conditions to understand the specific coverage limits.

Premium Costs:

Personal Income Protection Insurance premiums can vary based on factors such as age, occupation, health status, and the level of coverage chosen. The cost of premiums may increase as individuals age or if they have higher-risk occupations.

Group vs Individual Income Protection insurance

In general, a group income protection insurance policy is paid for by the employer.

Employees can purchase their own individual income protection policies, although it comes without the benefit of a group purchase. Their standalone policies will be much more expensive and provide fewer benefits. If you purchase a policy as a group, an insurer will usually be able to offer you a greatly reduced premium per person for a policy of higher value. Many features of the policy can also be negotiated and included for very little or no additional charge.

A group income protection policy is among the most highly regarded and requested employee benefits, believe it or not! This coverage is often negotiated with employers so that groups of employees can be covered as it offers true protection for employees and their families.

|

Factors |

Group Insurance |

Individual Insurance |

|

Coverage |

Provided by employer on behalf of employees |

Purchased individually from an insurance provider |

|

Continuity of Coverage |

Coverage may be lost if leaving the employer |

Coverage remains with the individual even if changing jobs. |

|

Payment Structure |

Premiums are usually deducted from employee’s paycheck |

Premiums are paid directly by the individual |

|

Customisation Options |

Limited customisation options |

|

|

Tailored Coverage |

Coverage is standardised for all employees |

Coverage can be tailored to individual needs |

|

Tax Deductibility of Premiums |

Premiums may be tax-deductible for employers |

Premiums may be tax-deductible for individuals |

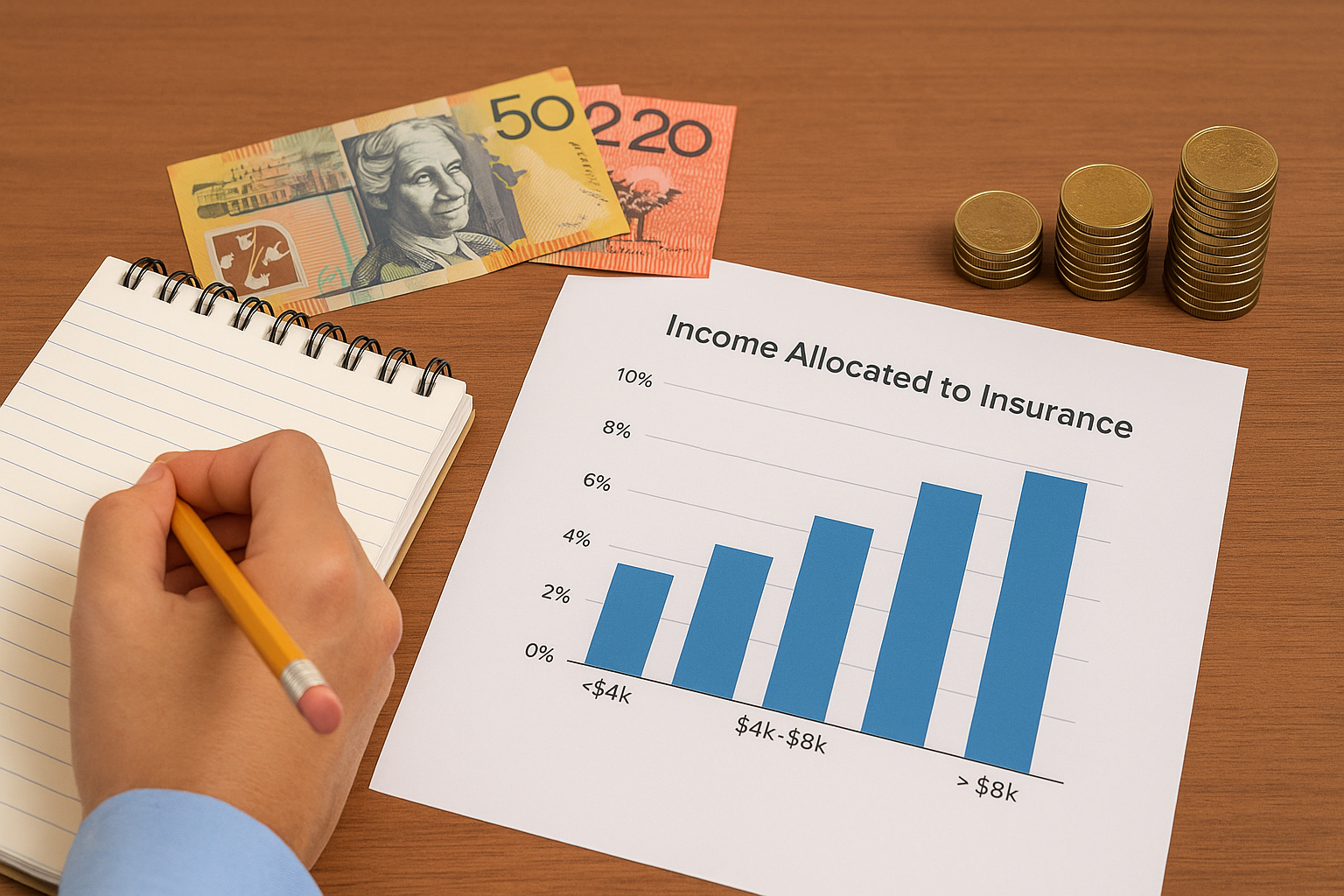

Coverage and Benefits

Group Insurance:

Group income protection insurance typically offers blanket coverage to all members of a particular group, such as employees of a company. The coverage benefits are predetermined and may include a percentage of the individual’s salary as a monthly benefit, rehabilitation support, and additional services provided by the insurer.

Personal Insurance:

Personal income protection insurance allows for more customisation. Individuals can tailor the coverage to their specific needs, selecting the desired benefit amount, waiting period (the time between the disability and the start of benefit payments), and benefit period (the duration of the benefit payments).

Tax Implications:

Group Income Protection Insurance: Premiums paid by the employer are generally tax-deductible for the employer. However, any disability benefits received by the insured employee are typically taxable as income.

Personal Income Protection Insurance: Premiums paid by individuals are not usually tax-deductible. However, any disability benefits received are generally tax-free, as they are replacing the individual’s lost income.

Cost:

Group Insurance: Group insurance is often more cost-effective due to the risk being spread across a large pool of members. The premiums are typically lower since the employer or group sponsor subsidises a portion of the cost.

Personal Insurance: Personal income protection insurance tends to have higher premiums as the coverage is personalised and based on individual risk factors and circumstances.

Portability and Continuity:

Group Insurance: Group insurance coverage is tied to the specific group or employer. If an individual leaves the group or changes employers, the coverage may be lost, and obtaining new coverage could be more challenging or expensive.

Personal Insurance: Personal income protection insurance is portable, meaning individuals can maintain their coverage regardless of employment changes. This ensures continuity of protection, even if switching jobs or becoming self-employed.

Customisation and Flexibility:

Group Insurance: Group insurance policies generally have limited customisation options. The coverage is designed to meet the needs of the entire group rather than individual preferences.

Personal Insurance: Personal income protection insurance offers greater flexibility and customisation. Individuals can select specific coverage features, adjust benefit amounts, and tailor policy terms to align with their unique circumstances.

Underwriting and Medical Requirements:

Group Insurance: Group income protection insurance often has simplified underwriting processes and may not require extensive medical evaluations for coverage eligibility.

Personal Insurance: Personal income protection insurance typically involves more detailed underwriting. Insurers may assess an individual’s health history, occupation, and lifestyle factors, which could affect coverage availability and premium rates.

Policy Control and Ownership:

Group Insurance: Group policies are typically owned by the employer or group sponsor, granting them control over policy terms, coverage limits, and changes.

Personal Insurance: Personal income protection insurance policies are owned by the individual, providing greater control over policy details, including the ability to make changes or adjust coverage as needed.

Key Factors to Consider When Choosing

When choosing between Group Income Protection Insurance and Personal Income Protection Insurance, individuals should consider several key factors that can help them make an informed decision. Here are some important factors to consider:

Employment Stability

Group Income Protection Insurance: If you have a stable job and expect to remain with your current employer for the foreseeable future, group insurance can provide reliable coverage.

Personal Income Protection Insurance: If you anticipate job changes or work on a freelance or self-employed basis, personal insurance offers more continuity and portability.

Customisation Needs

Group Income Protection Insurance: Group policies often have limited customisation options since they are designed to meet the needs of a diverse group of employees. If you have specific coverage requirements, personal insurance allows for greater customisation.

Personal Income Protection Insurance: Personal insurance provides the flexibility to tailor the policy to your specific needs, such as choosing the benefit amount, waiting period, benefit duration, and additional riders.

Coverage Continuity

Group Income Protection Insurance: Coverage under group insurance is contingent on your employment with the group policyholder. If you change jobs or the employer terminates the policy, you may lose coverage.

Personal Income Protection Insurance: With personal insurance, coverage remains in effect regardless of employment changes. It provides continuous protection even if you switch jobs, start your own business, or take a career break.

Premium Affordability

Group Income Protection Insurance: Group policies often have lower premiums due to the pooling of risks among a larger group. Premiums are typically shared between the employer and the employees.

Personal Income Protection Insurance: Personal insurance premiums are based on your individual risk factors. While they may be higher than group premiums, they offer the advantage of tailored coverage and the ability to choose a coverage level that fits your budget.

Risk Factors and Occupation

Group Income Protection Insurance: Group policies generally do not require extensive individual underwriting. If you have pre-existing medical conditions or work in a high-risk occupation, group insurance may be more accessible.

Personal Income Protection Insurance: Individual underwriting is conducted for personal insurance, which means your specific health history and occupation are considered. If you have a low-risk occupation or prefer more comprehensive coverage, personal insurance may be a better option.

So which one is better?

Group income protection is smart for everyone to be covered under one plan as it makes it more manageable for the employer. It usually requires a minimum of five employees to be covered for it to satisfy a ‘group policy’. Usually, this type of insurance is part of a comprehensive employee benefits package, which may also include health insurance and life insurance.

Individual income protection insurance can be a better type of policy for an employee who is seeking a more flexible arrangement regarding their personal employment plans.

Contact Aspect Underwriting if you are considering either of these types of policies. The income protection insurance we offer covers a wide range of income protection needs.

In conclusion, when comparing Group Income Protection Insurance and Personal Income Protection Insurance, it is important to consider various factors to make an informed choice. Employment stability, customisation needs, coverage continuity, premium affordability, and risk factors are key considerations.

Assessing personal circumstances, occupation, risk factors, and financial goals is crucial in determining the most suitable option. It is recommended to seek advice from insurance professionals who can provide guidance based on individual needs and preferences.

Remember, both types of insurance provide valuable protection by replacing lost income in the event of disability. By carefully considering the factors mentioned, individuals can make an informed decision that aligns with their specific situation and offers the necessary financial security.