At a glance:

- Income protection insurance premiums are tax deductible in Australia.

- However, there are certain criteria to meet in order to claim income protection insurance premiums as tax deduction.

- In future, there’s always room for change in the rules surrounding income protection insurance tax deductibility.

In the event of unforeseeable events that could affect your income, income protection insurance is vital. The premiums you pay for income protection insurance are tax deductible in Australia, so you can save money on your coverage. It can be difficult, however, to understand the tax deductibility of income protection insurance. The purpose of this guide is to provide you with a comprehensive understanding of the criteria, limitations, tax implications, and examples related to income protection insurance tax deductibility in Australia.

How does income protection insurance work in Australia?

The purpose of income protection insurance in Australia is to provide financial support in the event of illness or injury that limits your working capacity.

Individuals in Australia have income protection insurance policies that cover up to 75% of their income for a specified period of time, typically two years. Aspect UW can provide 85% income protection cover, the highest in the market.

For coverage, the policyholder pays a premium to the insurer. Depending on the policy, coverage periods may be shorter or longer, and policyholders may choose the waiting period before benefits are paid. Longer waiting periods result in lower premiums, with waiting periods generally ranging from 14 days to two years.

Individuals can claim income protection insurance benefits when they can’t work due to illness or injury. Upon receiving a claim, the insurance company will assess whether the policyholder is eligible for benefits. Policyholders will receive regular income replacement payments if their claim is approved.

Is income protection insurance tax deductible in Australia?

Yes, income protection insurance premiums is tax deductible in Australia. It is generally possible to claim a tax deduction for premiums paid if the policy is taken out to protect against a loss of income, according to the Australian Taxation Office (ATO).

However, income protection insurance premiums cannot be deducted unless certain conditions are met. Policies must be purchased outside of superannuation funds, and premiums must be paid after-tax income. Further, the policy must cover a policyholder’s regular income without including any lump sums, such as a death benefit.

Individuals’ personal circumstances can also influence how income protection insurance premiums are taxed, which may change over time.

Eligibility criteria for income protection insurance tax deductions in Australia

There are certain criteria to meet in order to claim income protection insurance premiums as a tax deduction in Australia.

Firstly, the policy must protect you against income loss caused by injury or illness. Tax deductions are not available for insurance policies covering other risks, such as trauma or total and permanent disability (TPD).

Second, you must hold the policy outside a superannuation fund. Policy premiums may still be tax deductible if held within a superannuation fund, but there may be differences in tax treatment.

The policyholder must also pay premiums out of his or her after-tax income. Pre-tax income, such as salary sacrifice, cannot be used to pay the premiums.

As a fourth requirement, the policy must cover the policyholder’s regular income without including lump sum amounts, such as a death benefit.

Last but not least, the policyholder must be able to provide proof of premium payments. You can do this by keeping track of your payments, such as by keeping bank statements and receipts.

Types of income protection insurance policies that may be tax-deductible in Australia

Listed below are some types of income protection insurance policies that may be tax-deductible in Australia:

Indemnity policies

Upon becoming disabled due to illness or injury, these policies cover a portion of the policyholder’s income up to the amount they were earning before becoming disabled. As a rule of thumb, indemnity policies are more affordable than agreed-value policies. However, benefits may fluctuate depending on changes in a policyholder’s income.

Agreed value policies

Typically, these policies cover a set percentage of an individual’s income, which is determined at the time of purchase. Policies that provide agreed values are more expensive than indemnity policies, but they provide more predictable benefits in the event of a claim.

Stepped premium policies

The premiums for these policies increase as the policyholder ages or as the policy matures. At first, stepped premium policies may appear more affordable, but over time, they can become increasingly expensive.

Level premium policies

The premiums for these policies remain constant throughout the policy’s lifetime. In the short run, level premium policies can be more expensive than stepped premium policies, but they offer long-term savings by locking in lower premiums.

In the event that my income protection policy is bundled with other covers, what can I claim?

Tax deductions may only be available for the portion of your income protection premium that specifically covers income protection if your income protection policy is bundled with other covers. For example, if you pay a total annual premium of $4,000, only half is allocated to income protection, and half is allocated to trauma insurance. It is only possible to claim a tax deduction for the portion of the premium that covers income protection, which is $2,000.

For income protection insurance, what are the tax deductions that I can claim?

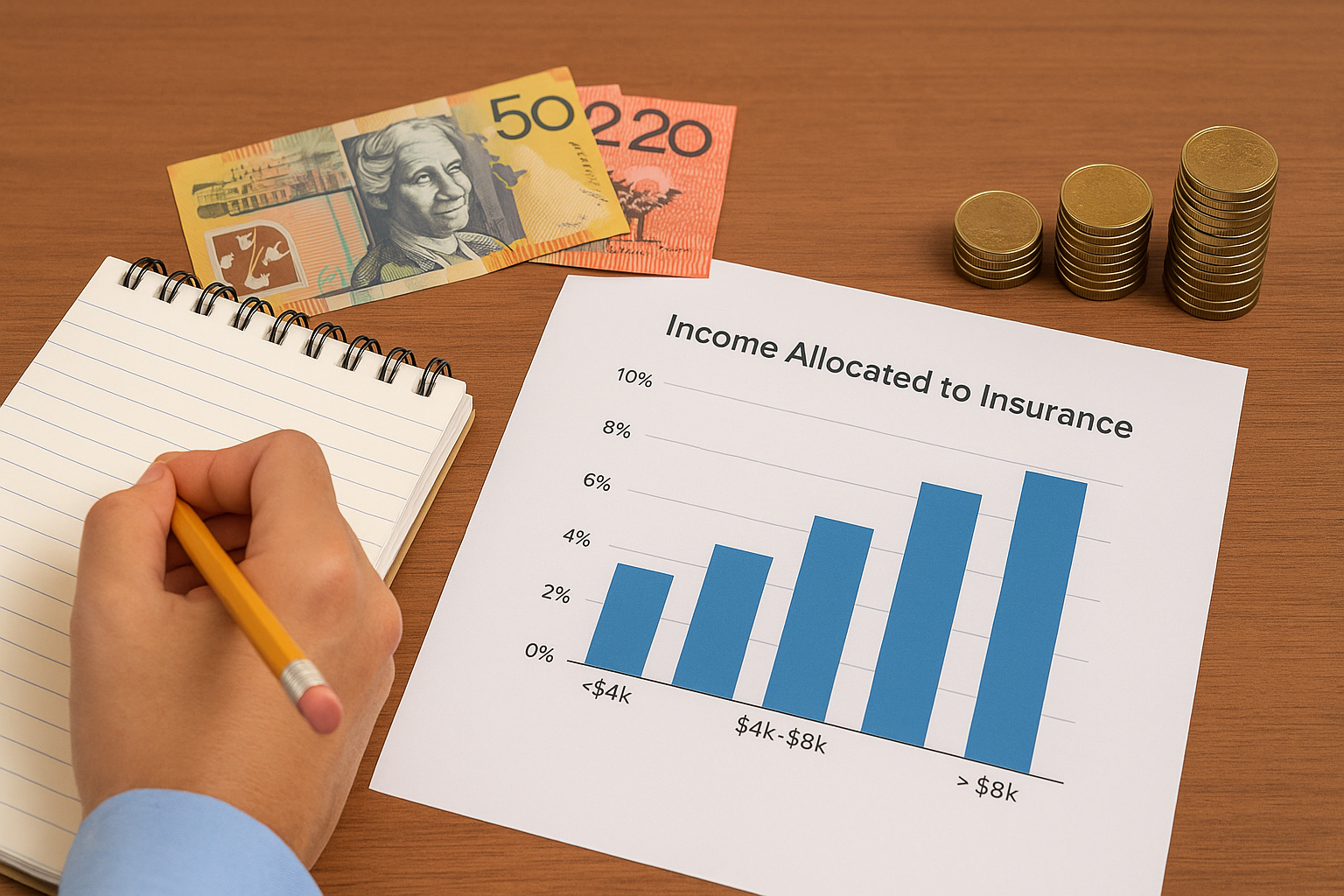

Generally, you can deduct your insurance premiums from your tax return if you have income protection insurance. However, your ability to claim may depend on various factors, including your taxable income, your tax rate, and the premium you pay. Depending on these factors, you may receive a different tax deduction, but you may be able to save a significant amount compared to your original premium.

Limitations and restrictions on income protection insurance tax deductions in Australia

Premiums for income protection insurance in Australia are tax deductible, but policyholders should be aware of certain limitations. These include

Maximum deduction limits

As a tax deduction, income protection insurance premiums cannot exceed a certain amount in Australia. Deductions are limited to $3,000 per year as of the 2022 financial year. Regardless of whether the policies cover different income streams, this limit applies to all income protection insurance policies held by an individual.

Benefit payment period

There is also a maximum benefit period for income protection insurance policies, which specifies how long benefits will be paid out for a claim. Tax-deductible premiums are not available for benefit payments that exceed the maximum period allowed under the tax laws.

Policy exclusions

Certain conditions or circumstances may be excluded from income protection insurance policies, including self-inflicted injuries, pre-existing medical conditions, or risky occupations. In the case of exclusions from coverage, premiums paid for those exclusions are not tax deductible.

Superannuation policies

Tax reductions are not available for income protection insurance premiums paid through superannuation. In the case of policies taken out through superannuation, the insurance premiums are deducted from your super contributions according to the ATO. The same applies to commercial and self-managed super funds.

Examples of income protection insurance tax deductions in Australia

The following are examples of how income protection insurance tax deductions work in Australia:

Example 1:

Emily earns $80,000 per year as a full-time employee. Currently, she has an indemnity income protection policy that costs $800 per year. During the financial year, Emily had to take four weeks of sick leave due to an illness, which exhausted her sick leave entitlements. In response to her income protection insurance claim, she received $2,000 in benefits. In the current year, Emily is able to claim an income protection insurance tax deduction of $800.

Example 2:

Trader Michael is self-employed and has income protection insurance with an agreed value. Approximately 75% of his income is protected, up to $100,000, with an annual premium of $2,000. After suffering an injury and being unable to work for six months, Michael received benefit payments of $37,500. As long as he meets the criteria, Michael is eligible to claim $2,500 as a tax deduction for income protection insurance premiums.

Example 3:

Sarah earns a high income and has income protection insurance at a level premium. She pays $7,500 each year for her policy, which covers 75% of her income up to $250,000. A pre-existing medical condition does not qualify for Sarah’s coverage, so she purchases a separate policy that covers it for $2,500 a year. Since Sarah’s income protection insurance premiums for the separate policy are not deductible, she can only deduct $7,500 in tax during the financial year.

Different income protection insurance policies offer different tax deductions based on individual circumstances and the type of policy.

Tax implications of claiming income protection insurance premiums as a tax deduction in Australia

In spite of the fact that income protection insurance premiums can reduce your taxable income, it’s important to consider the tax implications. Here are some key considerations:

Benefit payments may be taxable

Income protection policy benefits may be taxable if you receive them as a result of making a claim. If you’ve claimed a tax deduction for premiums paid, the benefit payments may need to be included in your tax return and taxed.

Tax rates may vary

Your benefit payments may be taxed differently depending on your personal circumstance and the type of policy you have. You may have to pay different tax rates if you have a policy that covers both income and capital benefits.

Deductions may be limited

A sole trader or employee may have fewer tax deductions available for income protection insurance premiums, depending on their income, the type of policy they have, and their occupation. Make sure you understand these limitations and claim only appropriate deductions.

Record-keeping requirements

Having receipts or statements from your insurer to support your deduction for income protection insurance premiums is required. As part of an audit or review, the Australian Taxation Office may request all relevant documents.

Comparison of income protection insurance tax deductibility in Australia with other countries

Different countries have different tax-deductibility rules for income protection insurance premiums. Below is a comparison of income protection insurance tax deductibility in Australia and other countries:

United States

It is generally not tax deductible for individuals to buy income protection insurance in the United States unless they own a small business or are self-employed. The premiums may, however, be deductible as a business expense if the policy is paid for by an employer.

United Kingdom

The United Kingdom does not generally allow individuals to deduct income protection insurance premiums. In the case of an employer-paid policy, however, premiums may be tax deductible.

Canada

Canadians’ income protection insurance premiums are generally tax-deductible as long as the policy is viewed as a “personal insurance contract” instead of a “group policy”. Deductions are, however, subject to certain limits.

New Zealand

It is generally tax deductible for individuals in New Zealand to pay for income protection insurance. Certain limits apply to the deduction, however.

Future trends and developments in income protection insurance tax deductibility in Australia

There is always room for change in the rules surrounding income protection insurance tax deductibility. Tax deductibility for income protection insurance in Australia could trend in the following directions:

Changes to eligibility criteria

As a way of ensuring that the system is fair and equitable for all taxpayers, the Australian government may change the eligibility criteria for income protection insurance tax deductions.

Expansion of tax deductibility

In order to encourage more people to take out income protection insurance, the government may decide to expand the range of policies that qualify for tax deductions.

Increased scrutiny

ATO may become more selective about allowing deductions for income protection insurance as they become more popular, ensuring that taxpayers are only claiming deductions to which they are entitled. Deductions for income protection insurance could be subject to more audits and reviews.

Technology-driven improvements

Technology advances may make it easier for insurers to provide tailored income protection insurance policies, allowing taxpayers to claim tax deductions and receive accurate benefits.

International harmonisation

The increasing number of people working remotely and crossing international borders may increase the pressure for countries to harmonise income protection insurance tax deduction rules so that taxpayers can simplify the process and reduce double taxes.

Purchasing income protection insurance

Depending on your circumstances, Aspect UW may be able to offer you tax-deductible income protection insurance policies. Get covered in 10 minutes by getting a quick online income protection quote from Aspect UW. Take advantage of income protection insurance from Aspect UW today. Click here to get started!