At a glance:

- Understand the importance of informing your insurer about employment changes to maintain comprehensive coverage.

- Fulfill your policyholder obligations and comply with terms and conditions for a strong partnership with your insurer.

- Keep your coverage up to date by promptly notifying your insurer about changes in employment status.

- Ensure accurate information for benefit assessment and eligibility determination.

- Proactive communication with your insurer protects your financial well-being.

As someone who holds an insurance policy, you understand the value of protection against unexpected events. It’s a reassuring feeling to know that you’ve taken the necessary steps to safeguard yourself against potential risks and uncertainties.

However, it’s important to remember that your relationship with your insurer should be more than just a one-time transaction. It’s an ongoing partnership that requires regular attention and communication.

Professional life is full of changes like shifts in employment status, it’s crucial to stay proactive and responsive to ensure your coverage remains relevant and effective. By staying engaged with your insurer, you can adapt your policy as needed and continue to enjoy the peace of mind that comes with comprehensive protection.

While not every change in your circumstances will require an adjustment in premiums, it’s important to proactively communicate any employment changes to your insurer. This is a crucial step to protect yourself from any potential misinterpretations in the disclosure agreement that could invalidate your policy and leave you without coverage when you need it most.

The good news is that reputable insurers like Aspect Underwriting work swiftly and seamlessly with you to ensure your coverage remains intact and up to date. Their commitment to providing a seamless experience means you can have peace of mind knowing that your policy is always up to date and tailored to your evolving needs.

Not all changes warrant a shift in premiums, however, they need to clearly communicate changes of your employment to your insurer are in your best interest. This is to safeguard against any interpretations in the disclosure agreement that could nullify the policy and leave you uncovered. The good news is there are reputable insurers, like Aspect Underwriting, that work with you in a swift and easy way to make the necessary changes in order to maintain your coverage.

Policyholders have an obligation to inform their insurers about any changes in employment status. By promptly communicating these changes, policyholders ensure that their coverage remains accurate and aligned with their current circumstances. This not only safeguards against potential policy nullification but also allows insurers to provide the appropriate support and guidance to policyholders during transitional periods. It is important to maintain an open line of communication with your insurer to uphold the integrity of your policy and ensure that you have the necessary coverage in place.

Potential consequences of not complying with this obligation

Policy Nullification

Failure to disclose employment changes can breach the insurance contract, allowing insurers to cancel the policy and remove coverage.

Coverage Gaps

Unnotified employment changes can lead to inadequate coverage or no coverage for specific job-related risks.

Denied Claims

Insurers review the policyholder’s circumstances when processing a claim. Undisclosed employment changes can result in claim denial for policy non-compliance.

Financial Burden

Undisclosed employment changes can lead to denied claims due to policy non-compliance. The impact on the validity of your policy and coverage cannot be underestimated. Failing to inform your insurer about significant employment changes or loss can have serious consequences. It is essential to understand that the validity of your policy and the extent of your coverage are directly influenced by your compliance with these obligations.

By neglecting to notify your insurer about job changes or loss, you run the risk of breaching the terms and conditions of your insurance contract. This breach could result in the insurer considering the policy null and void, thereby leaving you without the expected coverage. The insurer may argue that the non-disclosure of employment changes constitutes a breach of your duty of utmost good faith.

Obligations to Notify Your Insurer

When it comes to fulfilling your obligations to notify your income protection insurer about job changes or loss, there are specific guidelines to follow. These obligations ensure transparency and accuracy in your insurance coverage. Let’s explore the key aspects of notifying your insurer in different scenarios:

Change of Employment/Job

In the event of a change in your employment or job, it is important to promptly inform your insurer. Provide details about your new employer, including their name and contact information. Additionally, address the nature of your new job, highlighting any significant differences or changes in job responsibilities. This information allows your insurer to assess the impact of the job change on your income protection coverage accurately.

Job Loss

If you experience job loss, it is crucial to notify your insurer as soon as possible. This includes explaining the circumstances of the job loss, whether it was due to redundancy, termination, or other factors. It is advisable to submit any required documentation, such as termination letters or redundancy notices, to support your claim. Promptly notifying your insurer allows them to update your policy and assess any potential impact on your coverage.

Income Changes

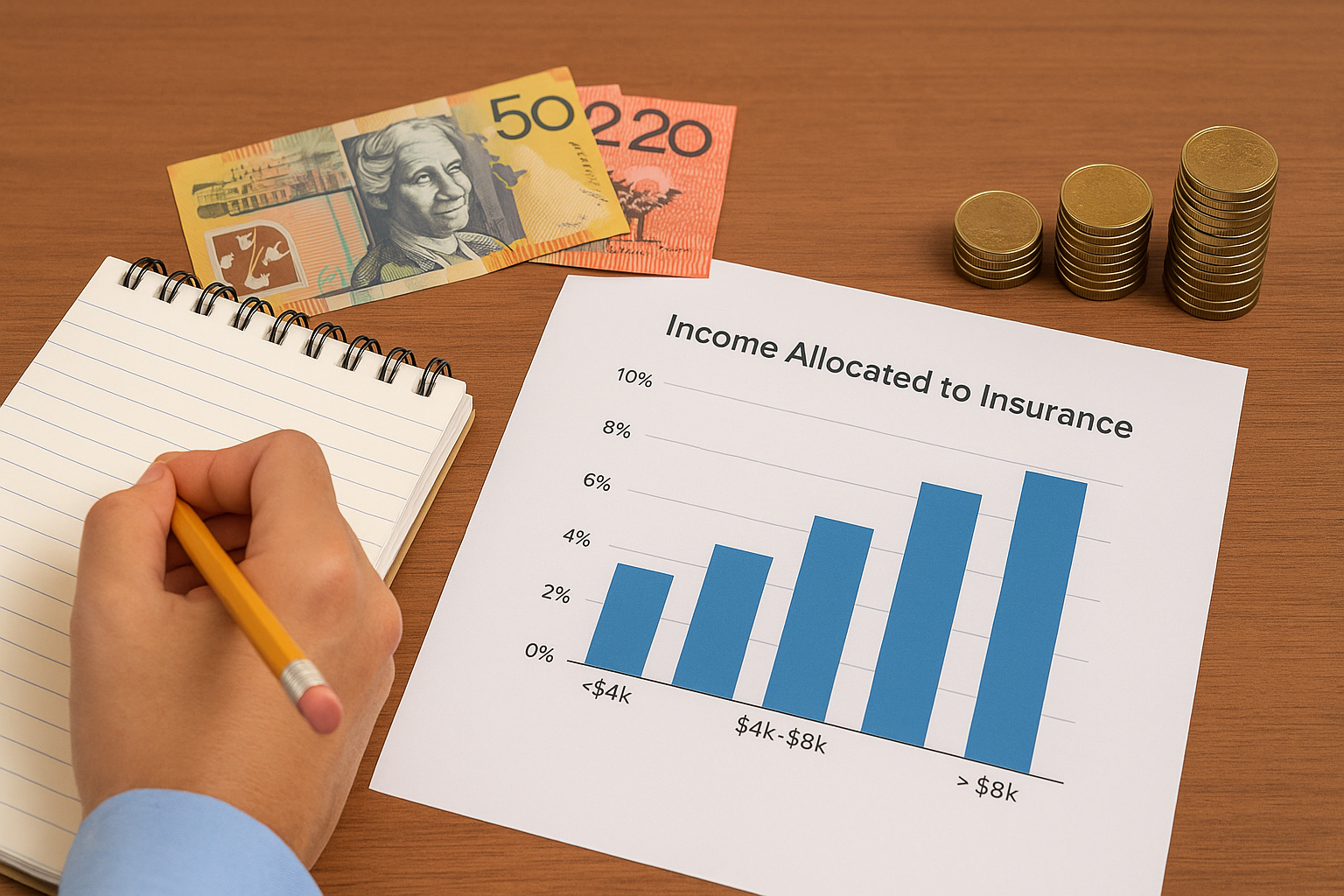

Significant changes in your income should also be communicated to your insurer. Inform them about any substantial increases or decreases in your income, as this can directly affect the benefits provided by your income protection policy. It is essential to provide accurate and up-to-date information to ensure your coverage aligns with your current financial situation.

Open and honest communication with your insurer is essential for maintaining the integrity of your insurance policy and securing the necessary protection for temporary disablement or loss of income.

Remember to consult your policy documents or contact your insurer directly to understand the specific requirements and procedures for notifying them about job changes, job loss, or income changes. Being proactive in fulfilling these obligations contributes to a smoother claims process and ensures that you receive the appropriate coverage and support when you need it the most.

The Importance of Informing Your Income Protection Insurer

Policy Compliance

As a responsible policyholder, it is important to fulfill your responsibilities and comply with the terms and conditions of your income protection policy. Notifying your insurer about changes in your employment status demonstrates your commitment to maintaining an accurate and up-to-date policy. By doing so, you adhere to the contractual obligations and ensure that you are fulfilling your part in the insurance agreement.

Update Coverage

Changes in employment can have implications for your insurance coverage and premiums. While not all changes may warrant a shift in premiums, it is in your best interest to clearly communicate any changes in your employment to your insurer. New employment terms may offer different coverage options or require adjustments to your policy. Additionally, certain jobs may involve higher risks, which may need to be assessed by your insurer to determine appropriate coverage adjustments. By providing accurate and timely information about your employment changes, you allow your insurer to update your coverage accordingly.

Benefit Eligibility

Changes in income, which can result from job changes or loss, can impact your eligibility for benefits under your income protection policy. It is essential to provide accurate information to your insurer, as it helps them assess your benefit eligibility based on your current circumstances. By keeping your insurer informed about income changes, you ensure that your benefits are accurately assessed and align with your financial situation.

Informing your income protection insurer about changes in your employment status allows them to make necessary adjustments to your coverage, assess any potential risks associated with your new job, and ensure that you maintain eligibility for benefits. Accurate and timely communication with your insurer is key to ensuring that your policy remains effective and provides the necessary protection in the event of temporary disablement or loss of income.

Remember to review your policy documents and consult with your insurer directly to understand their specific requirements for notifying them about employment changes. By doing so, you can stay proactive in fulfilling your obligations as a policyholder and maintain a strong relationship with your insurer based on trust and transparency.

Keeping your income protection insurer informed about any changes in your employment is crucial for maintaining comprehensive coverage. By fulfilling your responsibilities as a policyholder and complying with the terms and conditions of your policy, you ensure that your coverage remains valid and up to date.

Notifying your insurer about job changes allows them to assess the impact on your coverage, make necessary adjustments, and ensure accurate information for benefit assessment. Taking proactive steps to inform your insurer demonstrates your commitment to protecting your financial well-being. So, remember to stay proactive and keep your insurer in the loop regarding any employment changes to enjoy the full benefits of your income protection insurance.