At a glance:

- Evaluate your financial situation and health risks to determine coverage requirements.

- Research multiple providers for varying policy options and premiums.

- Consult with experts to navigate complexities and make informed decisions.

Trauma insurance can provide crucial financial support when you’re facing a serious illness or injury. However, it’s essential to be aware of the common exclusions and limitations that come with trauma insurance policies. We’ll explore these exclusions and provide strategies to minimise their impact. Whether you’re considering purchasing additional cover, selecting a policy with fewer exclusions, or negotiating with your insurer, we’ve got you covered.

Common Exclusions and Limitations in Trauma Insurance Policies

Exclusion Period

Most trauma insurance policies have an exclusion period, typically around 90 days. During this time, the insurer won’t pay benefits for traumatic injuries or illnesses. This often includes major events like heart attacks, cancer, strokes, and major surgeries.

Minimising Impact: To reduce the impact of this exclusion, consider policies that offer shorter exclusion periods or ones that waive the exclusion when transferring from an existing policy.

Self-Harm and Suicide

Trauma insurance policies typically do not cover self-inflicted injuries or illnesses. This includes traumatic events resulting from intentional self-harm.

Minimising Impact: Recognise that these exclusions are usually in place for the first 13 months of the policy, after which they may be waived. Seek professional help if you’re struggling with mental health to avoid these limitations.

Specific Policy Exclusions

If you have a pre-existing medical condition that increases your risk of suffering from a covered condition, insurers may exclude that condition or apply a loading to your policy.

Minimising Impact: Be transparent about your medical history during the application process to avoid potential exclusions or additional costs.

Undisclosed Pre-existing Conditions

Failing to disclose a medical condition that could have altered your policy assessment might lead to a claim denial or policy avoidance.

Minimising Impact: Always provide complete and accurate information on your application to ensure your policy aligns with your needs.

Policy Definitions

Each insurer has unique definitions and guidelines for their policies. It’s crucial to understand these before committing, as they can significantly impact your coverage.

Minimising Impact: Compare policies from different insurers to find the one that best matches your specific needs and offers clearer definitions.

Strategies to Minimise Exclusions and Limitations in Trauma Insurance

Trauma insurance is a valuable safety net, but it’s essential to minimise exclusions and limitations to ensure comprehensive coverage. Here are effective strategies to help you get the most out of your trauma insurance:

Comprehensive Policy Selection

When choosing a trauma insurance policy, opt for one that offers comprehensive coverage. While premiums may be slightly higher, this approach can significantly reduce the risk of exclusions and limitations.

Bundle Insurance Policies

Consider bundling your insurance policies, such as trauma insurance, with life insurance or TPD insurance. This not only streamlines your coverage but can also provide broader protection, minimising gaps in your financial security.

Transparent Medical History

During the application process, be transparent about your medical history. Failing to disclose pre-existing conditions or health issues may lead to claim denials or policy avoidance.

Negotiate with the Insurer

Engage in open communication with your insurer. If you have concerns about specific exclusions or limitations, discuss them with your insurer. They may offer options to customise your policy to better suit your needs.

Regular Communication

Maintain open lines of communication with your insurer. If your health status changes, or you have questions about your coverage, contact them promptly to ensure you’re making informed decisions.

Review Policy Documentation

Thoroughly review the Product Disclosure Statement (PDS) and any policy documentation provided by your insurer. This documentation outlines the specific terms and conditions of your coverage.

Ways to Maximise Your Trauma Insurance Coverage

Trauma insurance, also known as critical illness insurance, plays a vital role in protecting your financial stability when faced with a severe medical condition. However, understanding how to maximise your coverage is equally important. Here are strategies to help you get the most out of your trauma insurance:

Know the Difference

It’s essential to differentiate trauma insurance from other life insurance products. While life insurance pays out upon death or terminal illness diagnosis, TPD insurance covers permanent disability, and income protection provides ongoing monthly payments during illness or injury-related work absences.

Leverage the Lump Sum Payout

Trauma insurance provides a tax-free lump sum payment upon diagnosis of a specified medical condition. This sum can be utilised to compensate for lost income, cover medical expenses, make necessary lifestyle modifications, and more.

Understand Policy Inclusions

Familiarise yourself with the conditions covered by your trauma insurance policy. Coverage typically includes severe illnesses or medical crises such as heart attacks, cancer, major organ transplants, paralysis, and others. Each insurer may have a specific list of covered conditions, so review your policy carefully.

Clarify COVID-19 Coverage

COVID-19 coverage varies among insurers and policy conditions. Some insurers have processed claims related to COVID-19, while others are updating their policies to include it. To understand your coverage, consult your insurance broker directly.

Know When to Claim

If you are diagnosed with a covered condition, contact your financial adviser or insurance company promptly to initiate the claim process. Typically, there is an eight-week waiting period for trauma benefit claims, so providing accurate information promptly can expedite the process.

High-Level Tips for Choosing the Right Trauma Insurance Policy

Selecting the right trauma insurance policy tailored to your needs is crucial for your financial security. Here are high-level tips to guide you through the process:

Assess Your Needs

Begin by evaluating your specific needs and financial situation. Consider factors such as your current income, existing insurance coverage, savings, and potential medical expenses. This assessment will help you determine the level of coverage required.

Understand Your Risks

Identify the health risks and medical conditions that you are most concerned about. Trauma insurance is designed to cover specific critical illnesses, so choose a policy that aligns with your primary areas of concern.

Research Multiple Insurers

Don’t settle for the first insurer you come across. Research and compare trauma insurance policies from multiple providers. Each insurer may offer different coverage options, exclusions, and premiums, so exploring your options is essential.

Consider Policy Definitions

Pay close attention to the policy definitions and terms. Understand what qualifies as a covered critical illness and how severe it must be to trigger a payout. Clear definitions ensure you know exactly what your policy covers.

Review Exclusions

Thoroughly review the exclusions and limitations of each policy. Exclusions can vary significantly between insurers, so ensure that the policy you choose doesn’t exclude the specific conditions you’re concerned about.

Seek Professional Advice

Consider consulting a financial adviser or insurance expert. They can help you navigate the complexities of trauma insurance, assess your unique needs, and provide guidance on selecting the most suitable policy.

Evaluate Waiting Periods

Examine the waiting or exclusion periods associated with each policy. Some insurers may offer shorter waiting periods or waivers under certain circumstances. Choose a waiting period that aligns with your financial preparedness.

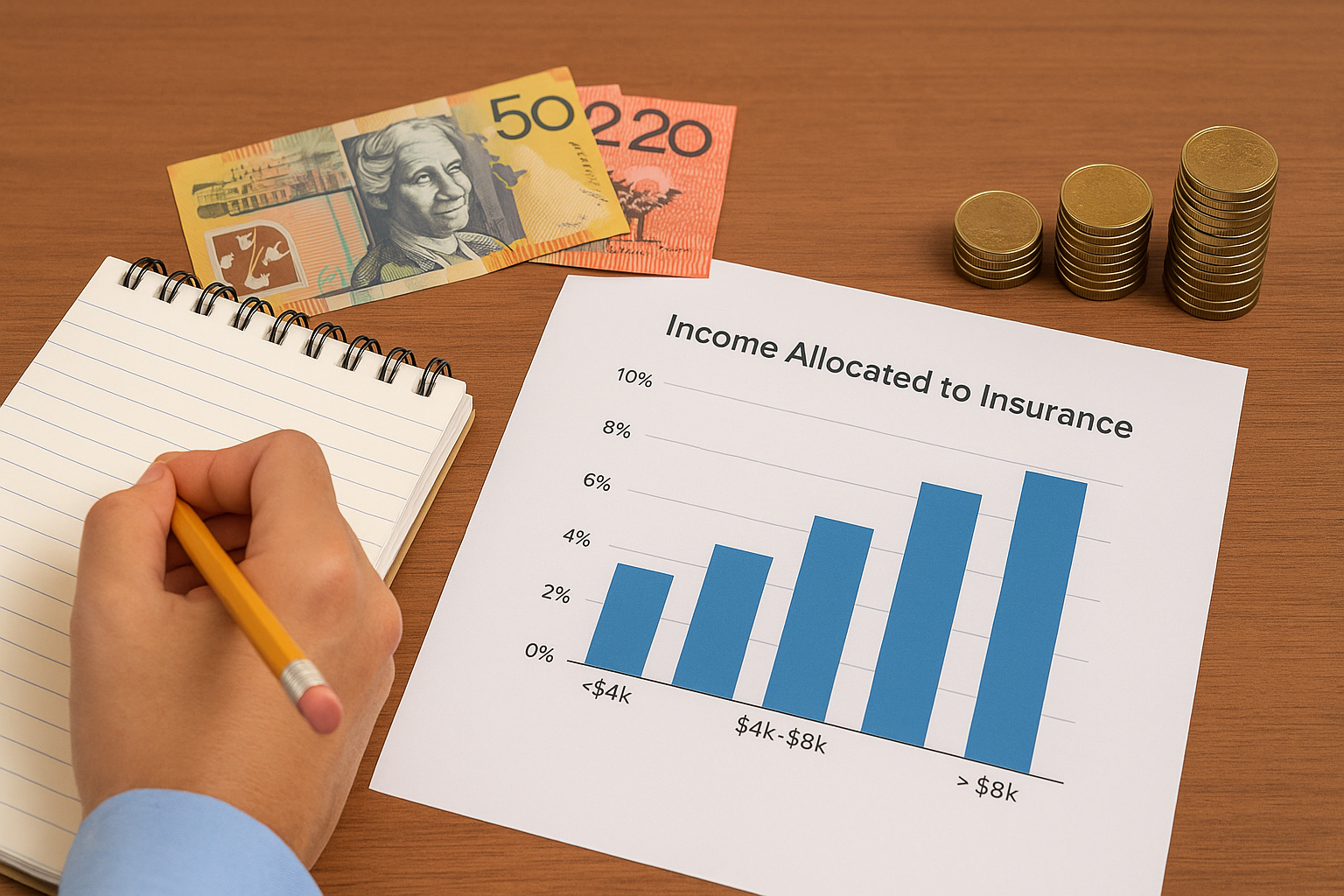

Review Premiums

Compare the premium costs of different policies. Keep in mind that premiums can vary based on factors like age, gender, occupation, and medical history. Choose a policy with premiums that fit your budget.

Read Customer Reviews

Look for customer reviews and testimonials about the insurer and policy you’re considering. Feedback from policyholders can provide insights into the insurer’s reputation and the overall satisfaction of customers.

Regularly Review Your Policy

After purchasing a policy, regularly review it to ensure it still meets your needs. Major life events, such as marriage, childbirth, or changes in employment, may necessitate adjustments to your coverage.

Consider Future Needs

Think about your future needs and long-term financial goals. Your trauma insurance should provide coverage not only for immediate concerns but also for potential future medical expenses and lifestyle changes.

Seek Customisation

If available, explore customisation options within the policy. Some insurers may allow you to tailor your coverage to specific needs, providing a more personalised solution.

Trauma insurance is a valuable safeguard for protecting your financial well-being during challenging times. Understanding and addressing common exclusions and limitations is essential to ensure your policy provides the coverage you need.

Whether it’s reducing exclusion periods, addressing self-harm and suicide clauses, or exploring additional coverage options, Aspect UW can help you make informed decisions about your trauma insurance. Remember that each policy is unique, so comparing options from various insurers is crucial to finding the best fit for your situation.