At a glance:

- Age, health, occupation, and lifestyle choices intricately shape TPD insurance premiums, demanding careful consideration for a well-informed coverage decision.

- Superannuation integration and stricter TPD definitions contribute to the Australian insurance landscape, influencing costs and requiring individuals to assess supplementary coverage needs.

- Striking the right balance is essential; while average costs provide a benchmark, personalised evaluation of income, dependants, and debts guides individuals in securing comprehensive TPD insurance without compromising financial stability.

Navigating the complex insurance landscape, especially when understanding the intricacies of Total and Permanent Disability (TPD) insurance, is akin to deciphering a cryptic code. In Australia, where unforeseen illnesses or injuries can profoundly impact one’s financial well-being, obtaining the right TPD coverage becomes not just a choice but a necessity. With an array of costs and coverage options, the pressing question of “How much TPD insurance do I need?” becomes a financial puzzle requiring thorough exploration.

This article explores TPD insurance costs in Australia, aiming to understand the factors that influence them comprehensively. By offering detailed insights into the cost landscape and helping readers assess their individual financial vulnerabilities, we aim to empower individuals to make well-informed decisions when choosing the right TPD cover, ensuring peace of mind in the face of unforeseen circumstances.

Why is TPD Insurance imperative in Australia?

Before delving into the intricacies of TPD insurance costs, it’s crucial to understand why this type of insurance is imperative in the Australian context. TPD insurance is a financial safety net that provides a lump sum payment if an individual becomes permanently disabled and cannot work. This lump sum payment is designed to cover many financial obligations, including medical expenses, mortgage or rent payments, debts, and providing ongoing support for one’s family.

Furthermore, TPD insurance can be a lifeline for financing rehabilitation, home modifications, and transport adaptations. It also considers the future cost of living, acknowledging that life does not pause after a disabling event. The need for TPD insurance is highly individual, allowing individuals to choose their coverage amount, with options extending up to $3 million. For those covered under a super fund, understanding the level of TPD cover within the fund can be obtained through member statements, product disclosure documents, or direct contact with the fund.

Factors Influencing TPD Insurance Costs

Understanding the components that shape TPD insurance costs is pivotal in making informed decisions. Here, we break down the key factors that influence these costs, highlighting their significance in the Australian insurance landscape.

Age and Health

The age and health of an individual play a significant role in determining TPD insurance premiums. Younger and healthier individuals typically enjoy lower premiums due to the lower perceived risk of disability. However, the risk increases as one ages or develops pre-existing health conditions, leading to higher premiums. Individuals should secure TPD insurance at a younger age when premiums are more affordable.

Occupation and Associated Risks

The nature of one’s occupation and its associated risks directly impact TPD insurance costs. High-risk occupations, such as construction or mining, naturally carry higher premiums due to the increased likelihood of accidents or injuries. Individuals in high-risk occupations should carefully assess their TPD coverage needs and be prepared for potentially higher premiums.

Lifestyle Factors

Lifestyle choices, such as smoking and alcohol consumption, can contribute to health risks and impact TPD insurance premiums. Smokers can expect expensive premiums as compared to non-smokers. Adopting a healthier lifestyle contributes to overall well-being and can result in lower insurance premiums.

Level and Type of Coverage

The amount of coverage chosen and the type of TPD definition (own occupation vs. any occupation) significantly impact premiums. Own occupation cover is generally more expensive but offers broader protection. Individuals should carefully evaluate their coverage needs and consider the trade-off between cost and comprehensive protection.

How These Factors Uniquely Impact Costs in Australia

The Australian TPD insurance landscape has unique features that differentiate it from other markets. Understanding these nuances is crucial for a more accurate assessment of costs.

Superannuation Integration

Many Australians have TPD cover integrated into their superannuation funds. While this provides a basic level of coverage, more is needed, necessitating additional insurance. Individuals should assess their superannuation TPD cover and consider supplementing it with standalone policies to ensure comprehensive protection.

Stricter TPD Definitions

Australian insurers have tightened TPD definitions in recent years, making it more challenging to claim benefits. This increased stringency can lead to higher premiums as insurers factor in the heightened risk of payouts. Individuals should thoroughly understand the TPD definitions in their policies and be prepared for potential challenges in claims.

Average Costs of TPD Insurance in Australia

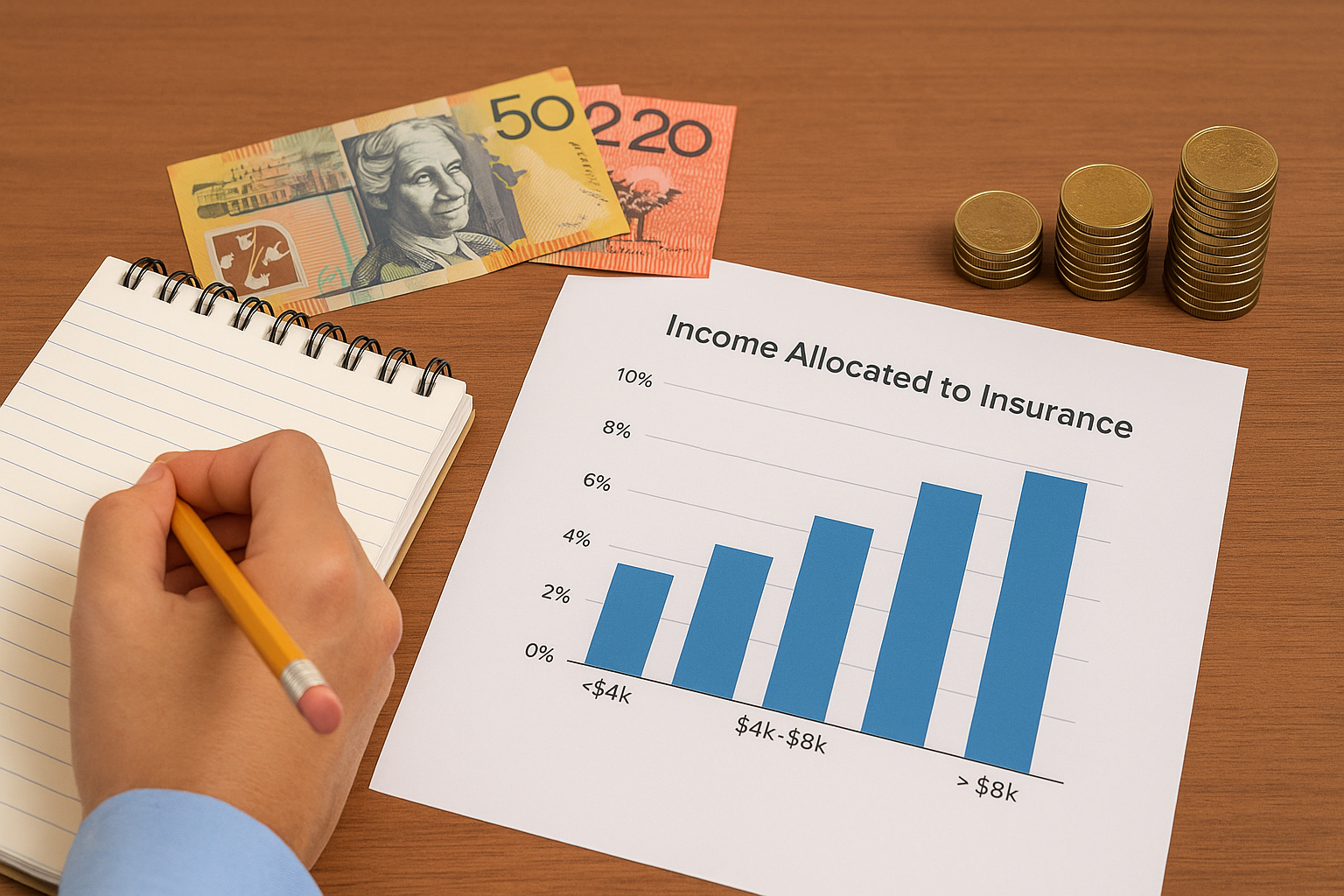

In Australia, the average cost of Total and Permanent Disability (TPD) insurance is approximately anywhere from $28 to $48 per month for someone in their 20s. While providing a specific cost is challenging due to individual factors, a general estimate can provide a benchmark for understanding pricing.

For instance, a 30-year-old male professional non-smoker might secure $500,000 in TPD coverage for approximately $5 a week. However, it’s crucial to emphasise that premiums vary based on individual circumstances. TPD insurance is an essential financial tool, providing immediate family or loved ones with the means to cover funerals, medical costs, and day-to-day living expenses.

How Much TPD Insurance Do You Need?

Determining the right amount of TPD cover is a nuanced process that requires careful consideration of individual needs and financial situations. While a comprehensive guide to assessing TPD insurance needs goes beyond the scope of this article, providing a framework for consideration is imperative.

Current Income and Expenses

Evaluate how much income would need replacement if the person is unable to work. Conduct a thorough assessment of current income and expenses to determine the financial impact of a TPD event.

Dependants

Assess if family members rely on your income. Consider the financial responsibilities towards dependants and factor this into the coverage amount.

Existing Debts and Assets

Consider financial obligations and savings. Evaluate existing debts and assets to understand the financial landscape and determine the appropriate coverage.

While a comprehensive guide to assessing TPD insurance needs goes beyond the scope of this article, valuable resources and calculators, such as Aspect’s, can aid in the process.

Balancing Cost and Needs

Striking the right balance between cost and coverage is paramount when considering TPD insurance. While the temptation to opt for the cheapest option may be strong, it’s essential to acknowledge that inadequate cover can leave one vulnerable in the event of a TPD occurrence.

Understanding the trade-off between cost and coverage is a delicate task. Working with insurance professionals or financial advisors who can provide personalised guidance based on individual circumstances is advisable. An investment in comprehensive coverage can be seen as an investment in long-term financial security and peace of mind.

In conclusion, understanding TPD insurance costs in Australia empowers individuals to make informed decisions about their financial security. By dissecting the factors that influence costs, assessing individual needs, and exploring available resources, individuals can confidently choose the right TPD cover that provides peace of mind without compromising financial stability.

Thorough research and professional advice remain indispensable allies in navigating the intricate realm of TPD insurance. The journey towards financial security is dynamic, and staying informed about evolving insurance landscapes ensures that individuals can adapt and make decisions that align with their ever-changing needs. When approached with diligence and understanding, TPD insurance becomes a powerful tool in safeguarding one’s financial future.